Overview of the Market

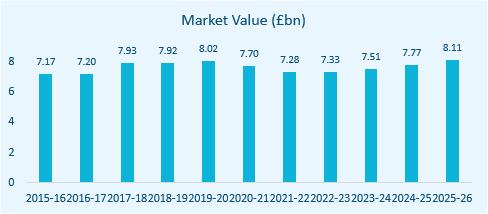

In the UK, the Residential Nursing Care industry is estimated to be worth approximately £7.7bn, with an annual growth rate of 1.4% between 2016 and 2021. The industry is also forecast to benefit from a 1.0% growth rate from 2021 to 2026.

Weak government funding and inflationary wage cost pressures have constrained industry margins over the past five years. The introduction of the National Living Wage and a labour supply shortage caused by falling immigration levels have been of particular concern to operators.

State involvement has put downward pressure on industry prices in recent years, to the point where fees provided per patient by the NHS and local councils are far below the operating costs of care homes. As a result, revenue generated from self-funded residents has subsidised the provision of state-funded care in the industry. Rising real household disposable income among the UK population over the past five years has led to a greater number of self-funded residents, which has aided industry revenue.

Robust demand from an ageing population is expected to aid industry growth over the next five years, while rising income levels and growing concern over the levels of state funding are expected to lead to particular growth in the private sector. While higher care fees are likely to improve the average margin in the industry in the long term, rising wage costs over the shorter term are anticipated to restrict profit margins. However, the COVID-19 pandemic is expected to continue to hamper the industry, and staff shortages are expected to be exacerbated over the coming period by the end of the free movement of people between the UK and EU.

Operating Conditions

One of the key operating conditions for the Care Home industry is the high level of industry assistance coming directly from the Government. Grants can also be awarded to Care Homes via charities. As NHS budgets have come under pressure in recent years, industry assistance from public sources has become increasingly constrained. Following the outbreak of COVID-19, the government has implemented a number of temporary measures to assist the social care sector. Government funding for local authorities has increased, by £1.6 billion in March 2020 and by a further £1.6 billion in April 2020, to support them in meeting pressures across the range of public services, including care homes.

Capital intensity of the Care Home industry is relatively low. Labour costs are the largest capital expense that Care Homes have to pay due to the level of personal care that residents receive and with few opportunities for technology to reduce labour costs

The rate at which technology changes within the industry is very low due to operations being labour intensive.

M&A Activity in the Sector

Statistics indicate a total of 408 significant deals from January 2011 to September 2021 in the Care Home industry. Typically, only deals over £500k are registered including MBIs, MBOs and secondary MBOs.

Upon breaking down the deal type, M&A activity within the sector is mainly categorised by acquisitions, with 382 occurring across the period. This is a reasonably strong level of acquisitions for the market size, showing that value is seen in the industry. There were also 15 MBOs, 5 MBIs and 5 secondary buy-outs that were completed.

Deal flow has had a scattered pattern with a general trend of growth, with a substantial rise in 2017. The downwards trend in deals since 2017 could be a result of Brexit uncertainty, alongside the detrimental economic effects of the COVID-19 pandemic. Forecasting the YTD figure for 2021 to the end of the year gives a total of 32 deals, slightly less than the amount of completed deals in 2020.

A geographical breakdown of the deals shows that the West Midlands dominates M&A activity, benefitting from 47 deals in the time frame. The rest of the deals are spread throughout other regions whilst slowly declining to Northern Ireland, with only 6 deals.

Industry Benchmarking Information – September 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| Care Home Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | 7.13 | 5.16 | (0.75) | 12.19 |

| EBIT Margin (%) | 10.30 | 12.66 | 1.07 | 22.73 |

| EBIT Growth/Decline (%) | 20.09 | 15.47 | (25.56) | 85.43 |

| EBITDA Margin (%) | 14.29 | 17.06 | 4.40 | 28.02 |

| EBITDA Growth/Decline (%) | 22.72 | 13.67 | (21.49) | 80.81 |

| Total Net Assets Growth/Decline (%) | 6.09 | 5.78 | (10.17) | 19.27 |

| Current Ratio | 2.47 | 1.06 | 0.40 | 2.29 |

Source

Experian Market IQ (September 2021)

Criteria

Using full company accounts filed in the last two years, excluding companies with nil turnover in either period.

Search Criteria: SIC-Code ’871 – Residential nursing care activities.’ AND ‘873 – Residential care activities for the elderly and disabled.’

Turnover below £20m.