Overview of the Market

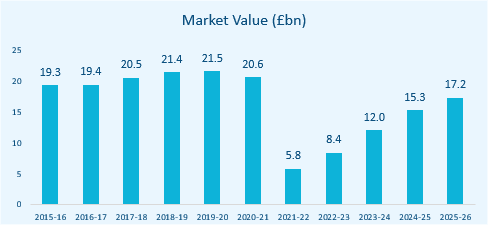

The UK Hotels industry is estimated to be worth approximately £5.8bn in 2021. Industry revenue has shrank at a compound annual rate of (21.5%) over the five years through 2020-21. The Hotels industry performed well at the start of the past five-year period. The weak pound had made the United Kingdom an affordable destination for international tourists, while weak consumer confidence led to a rise in domestic tourism over the period. Families have increasingly forgone overseas holidays, instead favouring staycations, benefiting domestic hotel occupancy rates. However, the COVID-19 (coronavirus) pandemic is expected to significantly disrupt the industry.

Lockdown measures have resulted in hotels closing for a significant part of 2020-21, contributing to an estimated 72.1% plunge in revenue. These forced business closures, combined with travel restrictions are expected to significantly reduce industry demand in the current year.

During the five years through 2025-26, industry revenue is forecast to rise at a compound annual rate of 26.9% to reach £19 billion. The vaccine roll-out and anticipated easing of restrictions from the start of 2020-21 is expected to support demand from domestic consumers. Improving disposable incomes and rising consumer and business confidence are anticipated to support revenue recovery over the period, although this could also encourage more overseas travel.

The end of the transition period is unlikely to deter inbound EU tourism, although the new immigration system could reduce the industry’s labour supply and weigh on margins. Websites such as Airbnb are anticipated to pose an increasing threat to industry operators over the next five years.

Operating Conditions

The industry is highly reliant on both labour and capital inputs. Using spending on wages as a proxy for labour costs and depreciation as a proxy for capital expenditure, it is estimated that for every £1.00 operators spend on capital, a further £4.88 is spent on labour, indicating that the industry has a moderate level of capital intensity.

The industry is characterised by a moderate level of technological change. Technology updates to hotels are often implemented to improve management and enhance in-room guest facilities. Most operators now receive a majority of their business through online booking platforms that allow guests to pre-book rooms and communicate additional needs.

The industry has displayed high revenue volatility over the past five years. It is sensitive to trends in both domestic and international tourism, which are themselves often determined by variable factors such as the weather and exchange rates. The COVID-19 pandemic has caused consumer and business confidence to plummet, reducing spending on industry services.

M&A Activity in the Sector

Market IQ data indicates a total of 537 significant deals, where data exists, in the industry from January 2011 to July 2021, with UK targets. Deals are only reported over a certain value threshold (c.£500k), therefore, it is likely that not all deals have been captured.

Upon breaking down the deal type, M&A activity within the sector is mainly categorised by acquisitions, with 501 since January 2011. There were also 18 MBIs and 15 MBOs. A geographical breakdown of the deals shows that London dominates M&A activity, benefitting from 76 deals in the time frame. The South West and North West were close behind, with 75 and 72 deals being completed respectively.

Deal flow has been significant in each year with a gradual upwards trend

through 2013-2017. This is likely characteristic of aggressive acquisition strategies from the larger players, as they attempt to fight off competition from the likes of AirBnB. With 16 deals through September 2021, forecasting the same rate to the end of the year gives 27 deals. The COVID-19 pandemic has caused a strain on deals, causing the dip in market activity from 2019 onwards. If the trend continues, this data would show a lack of confidence on the part of acquisitive businesses. Alternatively, confidence levels could be reflective of a poor quality of targets currently available in the UK market.

Industry Benchmarking Information – July 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| Hotel Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | (8.36) | (2.54) | (29.49) | 3.84 |

| EBIT Margin (%) | 2.60 | 3.10 | (13.05) | 15.50 |

| EBIT Growth/Decline (%) | (23.31) | (19.77) | (118.20) | 31.62 |

| EBITDA Margin (%) | 9.80 | 9.80 | (3.31) | 25.37 |

| EBITDA Growth/Decline (%) | (17.18) | (11.76) | (83.43) | 30.74 |

| Total Net Assets Growth/Decline (%) | (9.67) | (2.68) | (24.78) | 10.23 |

| Current Ratio | 2.66 | 0.60 | 0.17 | 1.53 |

| Acid Test | 2.63 | 0.56 | 0.15 | 1.49 |

Hotels Benchmarking

Using full company accounts filed in the last two years under the SIC-Code “551 – Hotels and similar accommodation”. Excluding companies with nil turnover in either period, we have summarised key benchmarking information for businesses under £20m turnover in the table above. July 2021.

M&A Activity Source

Experian Market IQ (July 2021)

Search Criteria: SIC-Code “551 – Hotels and similar accommodation”