Overview of the Market

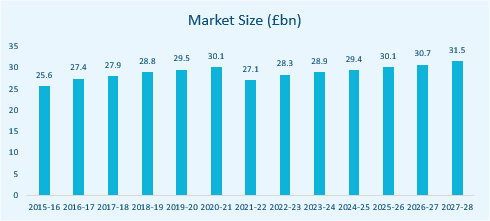

In the UK, the Motor Repair and Service Industry has an estimated market size of £28.3bn in 2021, a 10.1% decrease on the previous year due to the COVID-19 outbreak. The government implemented lockdown measures, which included a ban on non-essential trips, reducing car usage. As lockdown measures are eased from April 2021, demand is expected to expand, supporting revenue growth in the current year.

The industry has experienced a compound annual growth rate of 0.3% through the five years to 2021-22. In May 2018, the MOT classification was updated to include tougher rules for all vehicles. More stringent testing increased demand for MOT services, however, motorists were allowed to delay MOT tests for up to six months due to disruptions caused by the COVID-19 outbreak, which hindered revenue. Although Britons remain highly car dependent, rising fuel prices in some years resulted in declining car usage, which weighed on industry demand.

Over the next five years, the industry is expected to continue to grow at a compound annual rate of 2.2% through 2026-27 to reach £31.5 billion. An anticipated rise in car usage and customers delaying new car purchases are expected to support demand. A rise in the number of vehicles registered is also expected to support demand. An anticipated increase in household disposable income is expected to support demand for discretionary services over the next five years. Motorists are expected to maintain their current vehicles until disposable income and business expenditure recovers to pre-pandemic levels, boosting demand for industry services. However, fuel prices are forecast to increase over the five years through 2026-27, therefore increasing car running costs and discouraging people to drive, which reduces wear and tear and the number of incidents.

Operating Conditions

The industry displays a moderate level of capital intensity due to the need for equipment and facilities. Operators in the industry spend approximately £6.40 on labour for every £1 invested in capital. This level of capital intensity is unsurprising because of the reliance on manual labour for industry services..

There is a low level of technological change in the industry. Technological change for maintenance and repair providers comes in the form of upgrades to IT systems, innovative services like engine diagnostics and tyre recycling machinery.

Revenue volatility in the Motor Vehicle Maintenance and Repair industry is moderate. Industry revenue trended upwards for much of the period in line with rising disposable income and an increase in the average age of vehicles. The COVID-19 outbreak is expected to lead to a sharp decline in new vehicle sales due to the closure of non-essential businesses, including car dealerships. This is expected to have weighed heavily on industry revenue over the year.

M&A Activity in the Sector

Market IQ data indicates a total of 214 significant deals in the industry from January 2011 to October 2021, with UK targets. Deals are only reported over a certain value threshold (c.£500k), therefore, it is likely that not all deals have been captured. Data consists solely of Acquisitions, Management Buy-outs, Management Buy-ins, Secondary Buy-outs and Mergers.

Upon breaking down the deal type, M&A activity within the sector is mainly categorised by acquisitions, with 177 since January 2011. There were also 25 MBIs, 4 MBOs and 4 merger’s. A geographical breakdown of the deal shows that the South East & West Midlands dominate M&A activity, each with 36 deals, however the North West contributes a fair amount, with 9 deals. The remaining deals are spread through the U.K.; slowly declining in number to the North East, with just 3 deals.

Deal flow has been significant in each year, with a somewhat volatile trend through 2011-2017 and a significant spike in 2016. The subsequent dip in 2017 is likely characteristic of the uncertainty effect of the UK’s exit from the EU. Recovery followed in the subsequent years until deals dipped in 2020 as a result of the COVID-19 pandemic. However, forecasting the YTD figures to the end of this year gives 19 deals in 2021, showing promising signs of recovery as lockdown measures are eased.

Industry Benchmarking Information – October 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| Marketing Agency Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | (10.69) | (9.28) | (21.00) | 1.79 |

| EBIT Margin (%) | 2.68 | 3.51 | (0.82) | 9.09 |

| EBIT Growth/Decline (%) | (10.85) | (10.90) | (59.37) | 40.78 |

| EBITDA Margin (%) | 6.36 | 7.35 | 1.86 | 13.59 |

| EBITDA Growth/Decline (%) | 1.78 | (2.59) | (47.50) | 40.44 |

| Total Net Assets Growth/Decline (%) | 3.66 | 3.66 | (14.80) | 12.96 |

| Current Ratio | 3.47 | 1.47 | 0.95 | 2.68 |

| Acid Test | 3.10 | 1.13 | 0.66 | 2.07 |

Motor Service & Repair Benchmarking

Using full company accounts filed in the last two years under the search criteria, SIC-Code “452 – Maintenance and repair of motor vehicles”.

M&A Activity Source

Experian Market IQ (October 2021)

Search Criteria: : SIC-Code “452 – Maintenance and repair of motor vehicles“ and keywords concerning motor servicing.