Overview of the Market

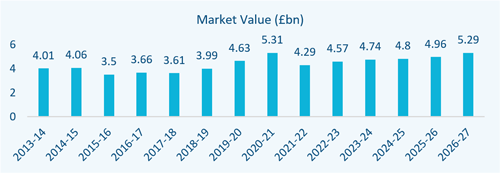

In the UK, the pre-primary education industry is estimated to be worth approximately £4.3bn and has benefitted from a growth rate of 3.3% from 2016 to 2021. This is forecast to increase from 2021 to 2026 with a growth rate of 4.3%. Demand for the industry’s services is largely dependent on the number of children under five years old in the United Kingdom, the level of female participation in the workforce, the working hours of parents, and changes in household disposable income.

Industry revenue is projected to rise at a compound annual rate of 4.3% over the five years through 2025-26 to £5.3 billion. The number of children under five in the United Kingdom is expected to decrease marginally over the next five years, however, the number of women in the labour force is expected to increase, leading employer-served nurseries to become increasingly popular. Although, an expected recession in the current year may mean firms are less likely to opt into childcare schemes. Also, higher unemployment and lower incomes in the short term could dent demand for industry services.

The introduction of 30 hours of free childcare per week is likely to maintain demand for industry services. However, possible underfunding could result in problems for many operators. Nevertheless, £66 million in funding for early-years provision, announced in the government’s three-year plan to boost school funding, should support revenue, which is forecast to rise at a compound annual rate of 3.1% over the five years through 2026-27 to reach £5.1 billion.

Operating Conditions

The industry displays a low level of capital intensity. For every £1 spent on capital, £22.53 is spent on wages, which is by far the highest cost for the industry, taking up approximately 76.6% of costs. This is due to nursery aged children requiring a high level of supervision, meaning that more staff have to be hired.

The industry displays a low level of technological change as pre-primary education does not typically involve a high level of technical equipment due to the very young age of students.

The industry is expected to display a high level of revenue volatility in the current year. This can be attributed to a 13% increase in capital government spending on education for under-fives in 2017-18, according to figures published in the Public Expenditure Statistical Anayses. However, revenue is projected to fall by 19.1% in the current year due to the forced closure of almost all industry establishments from March 2020 to June 2020, in line with government restrictions during the COVID-19 outbreak.

Market Share

The two major players in the market are as follows:

- Bright Horizons Family Solutions: Estimated 3.6%

- Busy Bees Day Nurseries: Estimated 3.2%

M&A Activity in the Sector

Statistics indicate a total of 253 significant deals in the Children’s Day Nursery Industry from January 2011 to July 2021. Typically, only deals over £500k are registered including acquisitions, management buy-out (MBOs) and management buy-ins (MBIs).

There was a total of 247 acquisitions as nursery chains look to expand by acquiring smaller competitors, increasing their turnover and reducing shared overheads. In addition, there were 3 Management Buy-Ins and 3 Management Buy-Outs.

Deal flow has been small in each year up to 2014 with a gradual upwards trend through 2018. The industry took a hit in 2019 and 2020 as stay-at-home orders were imposed, causing less parents to need day-care facilities. As lockdown measures are reduced in 2021, many will return to work, increasing the demand for nurseries once again. Forecasting data to the end of the year gives a total of 41 deals for 2021.

A geographical breakdown of the deals shows that the North West dominates M&A activity, benefitting from 58 deals in the time frame. The South East was close behind with 41 deals, whilst the rest of the deals are spread throughout other regions whilst slowly declining in popularity to Wales with 4 deals.

Industry Benchmarking Information – July 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| Nurseries Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | 14.47 | 5.27 | (3.59) | 24.59 |

| EBIT Margin (%) | 8.85 | 11.15 | (0.58) | 17.87 |

| EBIT Growth/Decline (%) | (12.81) | 1.07 | (43.42) | 38.82 |

| EBITDA Margin (%) | 13.25 | 15.26 | 1.71 | 22.75 |

| EBITDA Growth/Decline (%) | 6.29 | 8.60 | (34.67) | 29.90 |

| Total Net Assets Growth/Decline (%) | 23.02 | 14.22 | (6.54) | 32.07 |

| Current Ratio | 5.19 | 1.52 | 0.78 | 7.65 |

| Acid Test | 5.18 | 1.52 | 0.64 | 7.65 |

Nurseries Benchmarking

Using full company accounts filed in the last two years under the SIC-Code ‘851 – Pre-primary education’, Excluding companies with nil turnover in either period, we have summarised key benchmarking information for businesses under £20m turnover in the table above. July 2021.

M&A Activity Source

MarketIQ – SIC-Code ‘851 – Pre-primary education’ AND keywords concerning nurseries, July 2021.