Overview of the Market

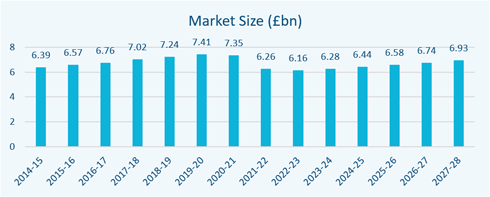

The estimated market size of the Plant Hire industry in the U.K. is £6.2bn. The industry is experiencing a negative compound annual growth rate (CAGR), expected to reach -2.6% through 2017-22. Many firms in the construction sector rent or lease equipment from the industry to minimise costs and support profit margins. As such, industry performance is tied to that of the wider construction sector. A surge in housing stats boosted demand substantially prior to the start of the period. However, increased competition has caused firms to cut prices to stimulate demand as well as demand from the commercial construction sector falling due to lower investor sentiment since the EU referendum and COVID-19 pandemic.

Squeezed budgets due to an expected economic recession as a result of the coronavirus pandemic is likely to encourage firms to delay purchasing equipment outright and enter rental contracts, benefiting demand. Public funding for infrastructure projects, government housing policies and low interest rates are also likely to support residential construction activity.

Operating Conditions

Capital intensity is high in the industry. It is estimated that for every £1.00 spent on capital, industry operators spend 69p on labour. The need to replace equipment and purchase additional capacity and the high cost per unit of much of the machinery results in capital costs outweighing labour costs. Updating equipment has become increasingly important in the industry because of more stringent environmental regulations, which is expected to increase capital intensity in the coming years.

Technological change is low in the industry. Like most retail industries, technological change has been driven by the development of online purchasing and booking systems and point-of-sale technologies.

There is a moderate level of revenue volatility in the industry. Industry revenue is mainly influenced by the level of activity within the construction sector as well as investment in new infrastructure projects. An overall increase in demand from the residential sector has also supported demand for construction equipment. Many residential contractors prefer to rent or lease equipment to avoid capital expenditure.

Market Share

Sunbelt Rentals Ltd is currently the largest player in the market with 6.2% market share. Other notable companies are:

- Speedy Hire plc

- HSS Hire Service Group Ltd

- Select Plant Hire Company Ltd

M&A Activity in the Sector

Statistics indicate a total of 224 significant deals from January 2011 to July 2021 in the Plant Hire industry. Typically, only deals over £500k are registered. Data consists solely of Acquisitions, Management Buy-outs, Management Buy-ins, Secondary Buy-outs and Mergers.

Upon breaking down the deal type, M&A activity within the sector is mainly categorised by acquisitions, with 188 since January 2011. There were also 21 MBOs, 7 MBIs and 2 mergers. There were also 4 Secondary Buy-outs. A geographical breakdown of the deals shows that the North West saw the most M&A activity, benefitting from 35 deals in the time frame. The South East has also seen a significant number of deals, with 31 deals completed. The remainder of the deals are spread throughout other regions whilst slowly declining to Northern Ireland, with just 4 deals.

Deal flow has been significant in each year with an increasing upwards trend through 2013-2017. This is likely a result of favourable economic conditions, as larger players look to consolidate market share. The coronavirus pandemic diminished the number of deals in 2020, with the detrimental effects still being seen in the current year as showcased by the disappointing deal data. If the trend continues, this data would show hindered confidence around acquisitive businesses.

Industry Benchmarking Information – July 2021

Hallidays’ client base consists of small to lower mid-market enterprises. Our benchmarking analysis reflects businesses with turnover below £20m, in line with the majority of our clients in this sector.

| Plant Hire Benchmarking Data | Mean | Median | Lower Quartile | Upper Quartile |

|---|---|---|---|---|

| Turnover Growth/Decline (%) | (3.43) | (2.91) | (18.29) | 7.15 |

| EBIT Margin (%) | 8.80 | 6.46 | 0.86 | 15.74 |

| EBIT Growth/Decline (%) | (6.47) | (8.30) | (54.18) | 37.82 |

| EBITDA Margin (%) | 18.03 | 16.22 | 5.00 | 33.60 |

| EBITDA Growth/Decline (%) | 0.81 | (3.09) | (35.30) | 26.58 |

| Total Net Assets Growth/Decline (%) | 2.85 | 4.18 | (5.39) | 14.82 |

| Current Ratio | 2.68 | 1.33 | 0.82 | 2.58 |

Market Research Benchmarking

Experian Market IQ (July 2021)

Using full company accounts filed in the last two years, excluding companies with nil turnover in either period.

Search Criteria: SIC-Code “7712 – Renting and leasing of trucks“ or “773 – Renting and leasing of other machinery, equipment and tangible goods“ Turnover below £20m.

M&A Activity Source

Experian Market IQ (July 2021)

Search Criteria: SIC-Code “7712 – Renting and leasing of trucks“ or “773 – Renting and leasing of other machinery, equipment and tangible goods“.