Overview of the Market

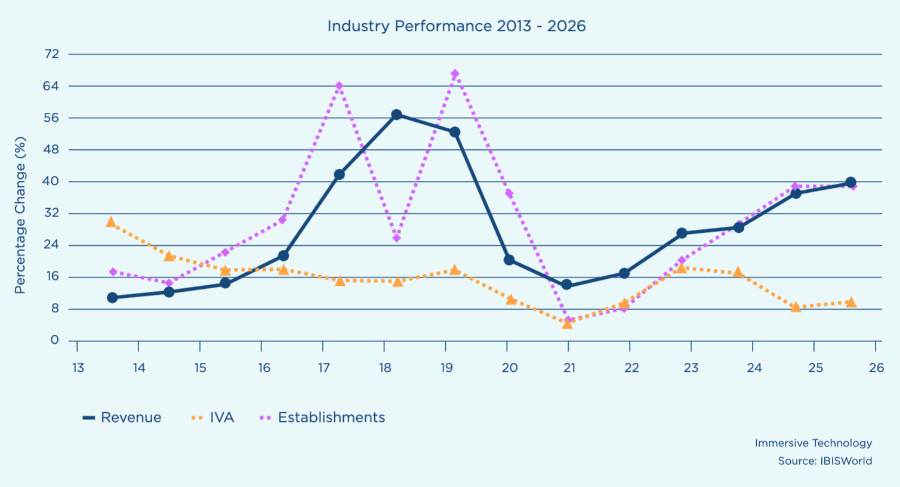

The UK Tech Sector industry is estimated to be worth approximately £1.5bn with an expected annual growth rate of 29.5% between 2021 and 2026. VR, AR, MR and haptic technology are becoming a staple in modern business, media and entertainment. The sector achieved significant growth with a large amount of funding from both the public and private sectors. However, the pandemic has posed challenges to collaboration, slowing innovation in the industry. The industry is likely to continue its impressive growth with supportive policy and funding. Investment focused on the development of immersive technologies will help pioneer the creation of original technology. Shifting perceptions on remote working could aid demand for immersive technology in training.

Further developments

- With an overall profit of £556.9m, profit increased by 51.9% from 2016-2021

- Tech business grew by 13% from 2016-2021, resulting in a total of 1398 tech businesses

- Wages increased by 21.3% from 2016-2021, which accumulates to an overall of £273.9m

Industry performance, key external drivers

IT and telecommunications adoption

The success of immersive technology specialists relies on the rate at which virtualreality, augmented reality, mixed reality and haptic technologies are incorporated in business processes and adopted by society. This trend can be proxied by the rate of wider information technology and telecommunications adoption, which is expected to have increased in 2020. As society becomes more comfortable with next-generation technologies in everyday life, new opportunities will emerge for immersive tech specialists to drive sales in new markets.

Research and development expenditure

Expenditure on research and development (R&D) is the foundation for success in the industry. R&D expenditure projects related to the development of immersive technologies help keep start-up specialists funded in the early stages of commerce.

Consequently, R&D expenditure by both private and public entities can keep start-up tech firms afloat and also gives impetus to the development of novel solutions, enabling operators to tap into new markets. In 2020, total R&D expenditure was expected to have risen, albeit more so steered towards efforts to help navigate the COVID-19 (coronavirus) pandemic.

Business confidence index

The business confidence index measures the expectations of businesses based on their assessment of output, current operating position and presumptions for the immediate future. When confidence increases, professionals will more likely dedicate investment to implement new technologies and systems into their business processes. Immersive technology solutions used for business processes have a high pricing point, so sales are sensitive to business sentiment and the propensity to invest. In 2020-21, business confidence is expected to decline amid pandemic-induced market disruption, threatening sales among more risk-averse clients.

Business software investment

Comprehensively speaking, UK businesses are a core market for immersive technology specialists. Virtual reality (VR), augmented reality (AR), mixed reality (MR) and haptic technologies have revolutionised many business processes, such as architectural design and communication methods, affording professionals efficiency gains and cost savings. As VR, AR, MR and haptic technologies develop, businesses will likely boost their investment in the value-added software solutions provided by operators. In 2020-21, business software investment is expected to increase. Despite financial uncertainty due to the COVID-19 (coronavirus) pandemic, enterprise software investment remains a priority for most businesses.